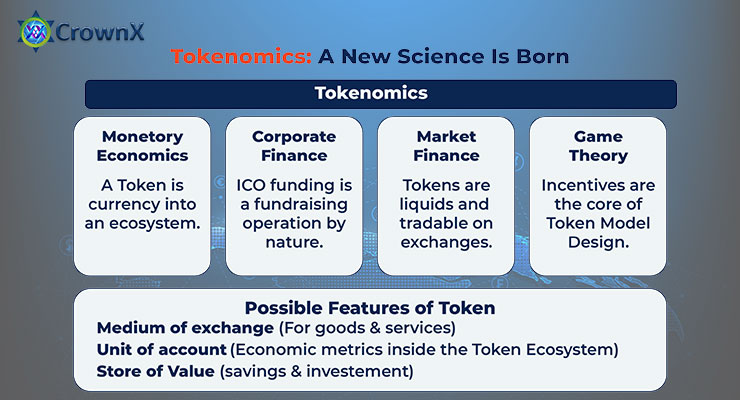

Tokenomics refers to the economic model and structure that governs the behavior and dynamics of a cryptocurrency or blockchain-based token. It encompasses various elements, including the distribution, supply, demand, utility, and value of the token within a specific ecosystem. Tokenomics plays a crucial role in shaping the token's overall functionality, adoption, and long-term viability.

Key Components of Tokenomics:

Token Distribution: Tokenomics begins with the initial distribution of tokens. This includes determining how many tokens will be created, how they will be allocated, and who will receive them. Distribution methods can vary, such as through initial coin offerings (ICOs), airdrops, mining, staking, or even direct purchase.

Supply and Inflation: The total supply of tokens and the rate of inflation or deflation over time are vital aspects of tokenomics. A controlled supply can help manage scarcity and potentially impact the token's value. Some tokens may have fixed supplies, while others might have mechanisms to adjust supply based on certain conditions.

Utility and Use Cases: Tokens derive their value from the utility they provide within a particular ecosystem. This could include enabling access to certain features, services, or products, as well as facilitating transactions or interactions within a decentralized network.

Staking and Governance: Many blockchain projects implement staking mechanisms where token holders can lock up their tokens to participate in network validation, consensus, or decision-making processes. This can influence the project's governance and direction.

Economic Incentives: Tokenomics often involves designing economic incentives to encourage desired behaviors within the ecosystem. These incentives might include rewards for users who contribute to network security, liquidity provision, or other valuable activities.

Burn Mechanisms: Some projects incorporate burn mechanisms, where tokens are intentionally removed from circulation. This can help manage supply and potentially drive token value by increasing scarcity.

Token Vesting and Lockups: To prevent rapid sell-offs by early investors or team members, projects might implement vesting periods or lockups, during which tokens cannot be freely traded.

Market Demand and Liquidity: Tokenomics also considers the factors that influence market demand and liquidity, such as trading volume, exchanges, market makers, and the overall attractiveness of the token for investors and users.

Network Upgrades and Forks: Tokenomics can be affected by network upgrades or forks that introduce changes to the token's underlying technology, governance structure, or economic parameters.

Community and Adoption: The success of tokenomics relies on community engagement and adoption. A strong user base and active participation can contribute to a healthy ecosystem and sustainable value for the token.

In summary, tokenomics is a comprehensive framework that governs the behavior of tokens within a blockchain ecosystem. It encompasses various economic principles, incentives, and mechanisms that collectively shape the token's value, utility, and overall role in its respective network. Effective tokenomics can play a pivotal role in the success and longevity of blockchain projects.